HST New Housing Rebate Services

Get Up to a $16,080 Maximum Rebate!

If you have recently built or renovated your home, you may be eligible for the HST New Housing Rebate. At Rebate4U, we specialize in recovering up to $16,080 of the Harmonized Sales Tax (HST) paid on new construction or renovations for homeowners. Our team is here to help you through the process and ensure that you receive the maximum rebate and fulfill all requirements.

Whether you're in GTA or in another city looking into the HST rebate in Ontario, we'll help you determine if you're eligible and assist you in applying for the rebate with ease.

Contact a Rebate Specialist Today!

How the HST New Housing Rebate Applies to You

If you've recently built your home, you could be eligible for up to $16,080 in rebates based on the HST you paid during construction. Here's why it matters to you:

If you've recently built your home, you could be eligible for up to $16,080 in rebates based on the HST you paid during construction. Here's why it matters to you:

- New Home Construction: If you have constructed a new home, you may qualify for a rebate of the HST paid for construction costs and materials.

- Primary Residence Requirement: The rebate applies only to homes used as your primary residence. This is important and, therefore, not to be overlooked when applying.

Why Choose Rebate4U?

At Rebate4U, we bring years of experience in the HST New Housing Rebate process as well as attaining over $20,000,000 in rebates to our clients. We understand the intricacies of the application, eligibility requirements, and deadlines. We have helped numerous homeowners claim their rebates successfully and save thousands of dollars. From preparing documents to submitting them, our team handles it all to make the experience smooth and hassle-free.

How Much Can You Get Back?

The highest rebate you can get is $16,080, but it depends on the total amount of HST paid. The rebate is the provincial portion of the HST paid on eligible expenses, including:

- Construction costs

- Building materials

- HST rebate on Renovations

Simple Steps to Get Your HST Rebate

Rebate4U makes the process very clear and straightforward. Here's how we help you:

- Eligibility Check: We determine whether your situation meets all the criteria for the qualification of the HST New Housing Rebate.

- Documentation Collection: We assist in compiling all the required documents for this rebate, such as proof of purchase, invoices, and proof that your home is your primary residence.

- Application Submission: Our company handles all the paperwork that is involved in submitting your application to the CRA on behalf of our clients.

- Rebate Approval: Once you are approved, we make sure that you get your rebate of up to $16,080 directly from the CRA.

How Rebate4U Helps Every Step of the Way

We are familiar with the complexity of rebate applications and how it is needed to be straightforward and as simple as possible. Be it your disqualification status or an overwhelmed pile of paperwork, Rebate4U is always here to help.

- Two-Year Window: Be sure to apply within two years of the construction or renovation completion date to ensure you don't miss out on your rebate.

- Timely Assistance: Our experts are ready to ensure that you go through a smooth process and meet all deadlines.

- Maximize Your Rebate: We work hard to ensure you get the maximum rebate possible, up to $16,080.

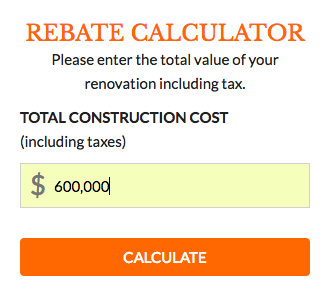

Example of rebate calculation:

Price of Renovations/ Construction: $600,000

The definition of a “house” with respect to a New Housing Rebate

When applying for a New Housing Rebate, a “house” may include the following:

- a detached/semi-

- Detached single family unit

- A duplex, condominium unit, or townhouse

- A single unit in a co-op housing corporation

- A mobile or modular home, or floating home

For the purposes of definition, a “house” may also include any nearby buildings like a garage or shed, and up to ½ hectare of land around.

A “house” may also include a bed and breakfast establishment where the rooms are rented out to the general public (only for the short-term).

NOTE: In a “bed and breakfast” scenario, more than 50% of the building must be allocated as the primary place of residence to legally qualify.

Get Started Today with Rebate4U!

Are you ready to claim your HST New Housing Rebate? The process can be quite complex, but with Rebate4U, you can rest assured your application is in expert hands. Contact us today to get started and maximize your rebate of up to $16,080.

Contact Your Rebate Specialists Today!

Rebate4U doesn't charge an upfront fee, the fee structure is based on success therefore the payment is only due after our clients receive their money from the government.