What is the HST New Home/Housing Rebate?

The Government of Canada created the HST New Housing Rebate program to help homeowners recover up to $16,080 of the HST they paid while building or renovating their homes. Since the program is only retroactive to two years from the date of completion of the renovation or construction, it is important that you will take advantage of this program right away before you will lose your eligibility.

Quick facts about the HST New Housing Rebate

Who is eligible for the New Housing Rebate?

In order to qualify for the rebate you must follow the following criteria:

- The house must be your Principal Residence

- The construction must have been done in the past 2 years

- You must have either: built a new home, gutted your entire home or built a major addition that doubles the size of your home.

In the province of Ontario, if you paid HST to purchase, build, or substantially renovate a home, then you may be entitled to the provincial New Housing Rebate. The New Housing Rebate is applicable on some of the provincial portion of HST paid.

The HST New Home Rebate allows individuals to recover some of sales tax paid out on a home that is being used as a primary residence, either personally or by a close relation. The rebate is only available to those who meet all of the conditions.

The New Housing Rebate is not available in a co-ownership arrangement, a partnership deal, or when a corporation is involved. Failure to comply with the conditions of the New Housing Rebate may compromise the rebate and require a full refund.

How does the HST Rebate work on new homes?

The Government of Canada has created the HST Rebate Ontario for new and pre-construction homes to help homeowners recover some of the HST paid while building or substantially renovating their homes. The rebate is applicable on a portion of provincial HST paid to the government and is only available to those who meet all conditions.

The program is retroactive to only two years from the completion of the construction or substantial renovation, and therefore it is important to take advantage of it before you lose your eligibility. Furthermore, in order for the homeowner to be eligible for the rebate, the home must be used as a primary residence, either by the homeowner or a close relative.

Additionally, the New Housing Rebate is not available in a partnership deal, co-ownership agreement, or in the event a corporation is involved. In case you fail to comply with the conditions of the rebate, a full refund may be required.

How much is the new home HST rebate in Ontario? What is the maximum new housing hst rebate possible?

The HST New Housing Rebate in Ontario is available to any homeowner who has completed a substantial renovation or construction work, as long as the other conditions of claiming the rebate are met.

In the case that the homeowner did not pay the HST on the purchase of the land, the HST New Housing Rebate will be equal to 75% of the provincial HST paid on eligible construction costs and materials. As such, the HST New Housing Rebate can help the homeowner to recover up to $16,080, regardless of the market value of the house when the construction is completed.

How long does it take to receive the HST Rebate?

The rebate application should be filed within 2 years from the possession date of the newly constructed house. In the case of a major addition or substantial renovation, the deadline to file the application would be 2 years from the project completion date.

Applications for the Ontario HST New Housing Rebate typically take anywhere between 4 and 16 weeks to process from the submission date.

What is the hst rebate new home deadline?

As mentioned earlier, the Ontario New Housing HST Rebate must be filed within two years from the closing date of your home or condo or within the two year period after the completion of renovations. The rebate can be claimed on building construction and land purchase fees incurred prior to the application.

In general, real estate rebate applications must be submitted within 24 months of a sale or renovation project. As such, the New Residential Rental Property Rebate (the NRRP Rebate) abides by the same timeline as the Ontario New Housing Rebate. However, the NRRP Rebate differs from the New Housing Rebate in that it is intended for new homes or condos, where the buyer plans to rent out the property.

With the Canada Revenue Agency, the deadline for the New Home HST Rebate must be strictly followed. In the case that the rebate application is late-filed, it will NOT be considered. However, extraordinary circumstances might allow for further consideration of your application. For example, events such as fire or flood, a disruption of postal service, or an accident or illness, may merit consideration of a late application. In addition, late-filed applications may be taken into consideration when the Canada Revenue Agency is responsible for the application’s late filing.

Claiming an HST New Housing Rebate for an owner-built house

In order to claim an HST New Housing Rebate for an owner built house:

- you must build (or engage someone to build) a house on land that you own or lease

- you must substantially renovate (or engage someone to renovate) an existing home

- “substantial” means at least 90% (interior) of an existing home must be removed/replaced

- you must renovate/build a major addition to your home that doubles the size of the space

- (adding a porch, sunroom, bedroom, or family room is NOT considered a major addition)

- you must completely convert a previously non-residential property into a residential home

- you must purchase a new or substantially renovated mobile home or new floating home

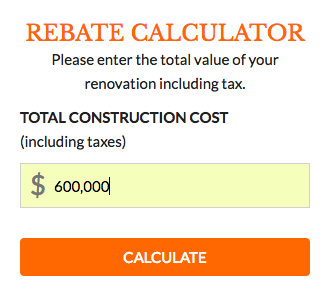

Example of rebate calculation:

Price of Renovations/ Construction: $600,000

The definition of a “house” with respect to a New Housing Rebate

When applying for a New Housing Rebate, a “house” may include the following:

- a detached/semi-detached single family unit

- a duplex, condominium unit, or townhouse

- a single unit in a co-op housing corporation

- a mobile or modular home, or floating home

For the purposes of definition, a “house” may also include any nearby buildings like a garage or shed, and up to ½ hectare of land around.

A “house” may also include a bed and breakfast establishment where the rooms are rented out to the general public (only for the short-term).

NOTE: In a “bed and breakfast” scenario, more than 50% of the building must be allocated as the primary place of residence to legally qualify.

Understanding the definition of “primary residence”

One of the principle conditions for a New Housing Rebate is that the property must be a primary place of residence for yourself or a close relation. A so-called “primary residence” is a home that you own (even jointly) and intend to live in permanently.

An individual may have more than one place of residence, but only ONE “primary residence”. If the “primary residence” remains outside of Canada, any home in Canada is considered to be a secondary residence and will not qualify for a rebate.

In order for the applicant to be eligible for the New Housing HST Rebate, a new condo or house must be used as the primary residence by the applicant or their immediate family. The term “immediate family” refers to the people related by marriage, common-law, blood, or adoption. There are several factors taken into consideration by the Canada Revenue Agency when determining if the house can be defined as the person’s primary residence. Such factors include whether the individual considers the house as their main residence, how long they have been living in the unit, and if they have used this address on any public or personal records, such as a driver’s license.

Condo and house builders in Ontario generally credit the total amount of the HST Home Rebate towards the house’s sale price. In certain rare circumstances, the builder might pay the rebate directly to the buyer. This can provide the purchaser with enough money to finish their new house or condo without the need for a cash back mortgage.

Factors that determine if a home is your “primary residence”

- if you consider the home to be your main living residence

- if the residential address appears on personal/public records

- if the original intent of the home is to be a “primary residence”

A home is NOT a “primary residence” if it will be used some time in the future – like at retirement time. For rebate purposes, a vacation cottage or investment property is also NOT “primary”.

The process of obtaining the rebate includes:

1. Calling Rebate4U at 1-800-610-4510 to verify that you qualify

2. Book a meeting with a rebate specialist.

3. Prepare the following documents for the meeting:

- All your construction invoices

- Copy of your home insurance policy

- Floor plans

4. Receive your maximum rebate.

Rebate4U doesn't charge an upfront fee, the fee structure is based on success therefore the payment is only due after our clients receive their money from the government.